The income tax department on Tuesday asked taxpayers to link their PAN with their Aadhaar by May 31 to avoid tax deductions at a higher rate.

As per income tax rules, if a Permanent Account Number (PAN) is not linked with a biometric Aadhaar, TDS is required to be deducted at double the applicable rate.

Last month, the income tax department issued a circular stating that no action will be taken for short deduction of TDS in case the assessee links his/her PAN with Aadhaar by May 31.

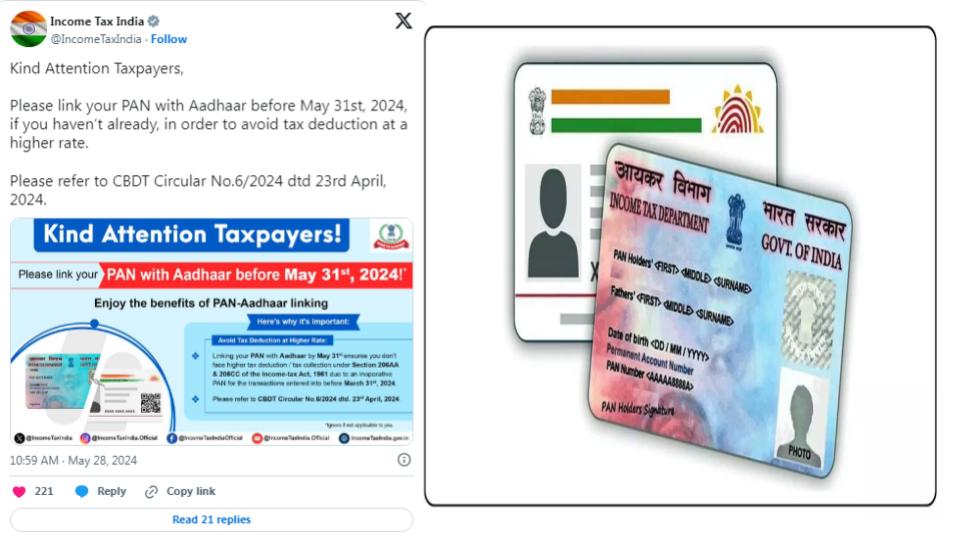

Please link your PAN with Aadhaar before May 31, 2024, if you haven’t already, in order to avoid tax deduction at a higher rate,” the department posted on X.