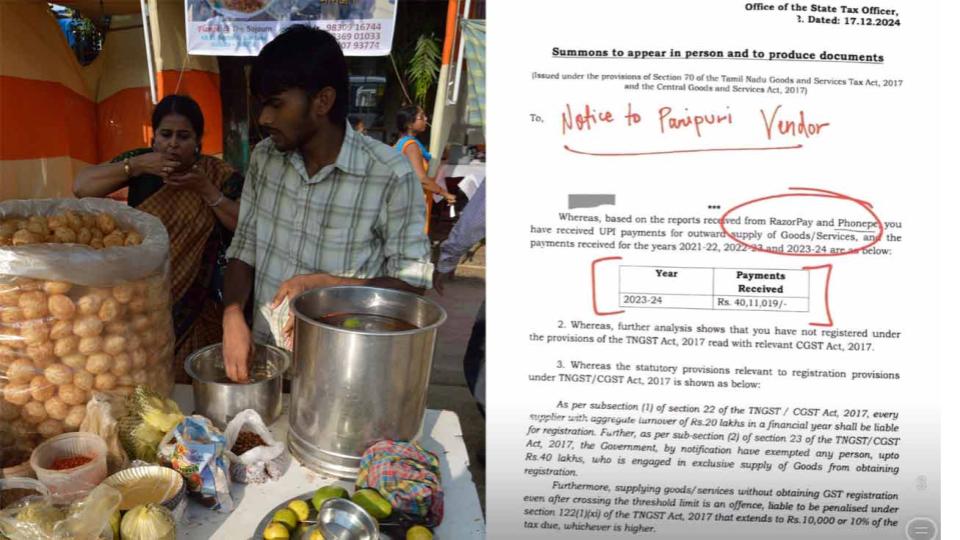

In rather surprising turn of events, a pani puri vendor has received a GST notice in Tamil Nadu after his online payments skyrocketed beyond Rs 40 lakh in a year. The notice has much depended on records from payment platforms like PhonePe and Razorpay and brought the vendor’s income from online transactions under scrutiny. The vendor’s case has led to a raging debate on social media with many questioning whether small street vendors should be subjected to the GST law for income.

The GST notice raises an alarming picture of the booming informal economy, where digital payments are successfully bringing small businesses under the radar of taxation. Obviously, many voices in favor of small vendors argue against this based on the small profit margins that such businesses often exercise.